Spends & Trends In IA 2021 Annual Report

2021 Trends in IA

Add bookmark

Executive Summary

2020 and the first half of 2021 has been a wild ride for many companies. The global pandemic along with the ensuing economic crisis and skilled talent shortage has put digital transformation at the forefront of everyone’s mind. However, are companies actually accelerating their investments in automation or is it all just hype? Furthermore, if companies are in fact embracing automation at unprecedented rates, where exactly is the money going?

To answer these questions, we at the Intelligent Automation Network surveyed 250+ senior digital transformation leaders to find out what types of advanced business process automation tools they’re investing in and where they’re seeing the most value. What we found was a bit more complex than anticipated.

While interest and budgets for business process automation solutions are certainly increasing, long-term, sustainable innovation at a number of organizations has stalled. While more technologically advanced and, often, larger companies are off and running with these solutions, other organizations are struggling to get their initial automation projects off the ground.

In other words, we’ve entered an age of automation haves and have nots.

What seems to be holding many organizations back is a lack of a clear, enterprise-wide strategy for digital transformation and, ergo, global end-to-end enterprise automation. For example, many of our respondents seem to be juggling multiple, potentially overlapping solutions.

In addition, while many companies are racing to adopt advanced automation tools such as RPA (43%) and workflow automation (54%), a surprising number of organizations are overlooking foundational technologies, such as automated process discovery, that help ensure the success of more advanced automation applications.

While 2020 was a year defined by survival, 2021 is modelling out to be a year of reinvention. The events of the past year have inspired many organizations to reimagine their approach to automation from one-and-done to continuous delivery and hyper automation. Instead of purchasing one solution at a time, organizations are looking to build agile, consolidated automation stacks whereby multiple, unified technologies work together in harmony across the enterprise.

ALSO READ: A Surge in RPA Adoption

Survey Methodology and Respondent Profiles

The digital transformation leaders we surveyed come from all across the globe and represent a wide range of functions, industries and maturity levels.

Breakdown By Region

Industry Outlook At-A-Glance

Which of the following solutions are you currently leveraging?

Are you looking to invest in any of the following solutions over the next year?

As you can see, many of our respondents have already begun their digital transformation journeys and, over the next year, are looking to take it to the next level by reallocating their budgets towards more advanced, intelligent automation tools.

In addition, this shows that many companies are looking to replace their outdated, business process management (BPM) system with more sophisticated automation tools. In fact, the term “business process management” may be falling off the map all together.

While many of the large, incumbent BPM solution providers still have a strong market presence, most have evolved into other vendor categories such as low-code, RPA and/or intelligent automation solutions.

Scalable Intelligent Automation

Robotic process automation (RPA) and Intelligent Automation (IA) have proven to be powerful enablers of digital transformation. By automating and digitizing business processes, cognitive technologies not only reduce costs and increase productivity, but they also enable organizational agility, facilitate next generation data and analytics capabilities, and boost a company’s overall competitive advantage.

However, IA, especially, can be costly and difficult to implement. It often requires significant restructuring of an organization’s IT environment as well as the hiring of new, skilled talent and the extensive reskilling of current employees. As a result, the indirect costs of IA implementation alone can easily outweigh the proposed benefits, especially if the solution is only applied to low value processes.

Scalable IA: Current State

In order to achieve true ROI, IA and RPA capabilities must be scaled across the entire enterprise. However, only 12% of our respondents have done this. In addition, 43% of respondents have automated less than 10% of business processes.

Furthermore, at most companies, only a very small percentage of employees are currently leveraging intelligent automation. Almost 93% of our respondents said that less than half of their enterprise workforce utilized IA.

Not only does this point to the fact that the vast majority of companies have quite the ways to go when it comes to scaling and, ultimately, reaping the full benefits of IA, it also reflects the ongoing talent crisis that many organizations are facing.

Putting IA tools in the hands of non-technical employees is about more than just immediate profitability, it’s also about future proofing one’s workforce. AI and ML-fuelled automation is rapidly permeating all areas of business and organizations that wait to upskill their talent and prepare them for this new norm could suffer dire economic consequences.

Furthermore, leading-edge companies such as Amazon, Nationwide and Verizon, just to name a few, have linked the democratization of technology with increased overall innovation. By putting IA and other transformational tools such as low-code and advanced analytics in the hands of its employees, organizations can tap into the genius of “citizen” developers and analysts to deliver products that are fully aligned with business objectives.

Have you scaled your IA efforts?

What percentage of your company’s workforce utilizes Intelligent Automation?

What percentage of your business processes are automated?

Scalable IA: Emerging Trends

The silver lining is that, of those who have yet to fully scale IA, 85% say that achieving scalability is a priority for them, with 44% indicating that they have already begun this process. Plus, 43% of respondents expect their final, approved budgets for scalable IA solutions to increase over the next year.

When it comes to execution, about 58% of our respondents have launched automation centers of intelligence or plan to within the next year.

When asked about the potential benefits of enterprise IA, the top 3 selections were increased operational efficiency (91%), enhanced data analytics capabilities (63%) and improved organizational resilience (48%).

However, a number of ongoing challenges and obstacles still remain.

The top 3 barriers to successfully scaling IA, according to our respondents:

- cost to implement (71%)

- lack of skilled talent (61%)

- IT readiness (45%)

Though, for now, many IA solutions may be out of reach for some organizations in terms of budget and resources, this seems to be changing. Innovations such as low code are making automation both cheaper and easier to implement as they don’t require the same level of expertise or computing resources. In addition, cloud computing, edge-computing and their ever-evolving financial models could also increase the affordability and accessibility of IA in years to come.

As for the lack of skilled IT talent, as previously mentioned, forward-thinking organizations are focused on building up their existing talent to fill in the gaps. In addition, many organizations are reimagining how they approach recruiting and engaging IA talent. For example, research has shown that technical talent is tends to be concentrated around major cities so many organizations are either deepening their presence in those locations or strengthening their remote work options. Many companies are also turning towards part-time or contract work arrangements while others are offering out-of-thebox employee benefits such as flex hours, personalized workspaces and tuition reimbursements.

“Innovation is less about technology and more about transforming people and mindsets. It requires inspiring people being part of the journey and take ownership of innovation. So they feel on board and part of the process. This requires being humble, sitting down with them, actively listening and showing empathy.”

Guilhem Vincens

ABN AMRO Bank’s Head of Change and Innovation APAC.

Workflow Automation & Orchestration

An essential step towards digital transformation and hyper automation, workflow automation automates the flow of tasks, documents, and information across work activities in accordance with defined business rules. Workflow management systems (WMS) allow organizations to not only model and re-engineer routine, repeatable activities to maximize efficiency, they also automatically trigger work tasks and route them between people, technology - a process known as workflow orchestration.

Adoption & Spend

Given the critical role workflow automation plays in not only optimizing end-to-end business processes but scaling cutting-edge technology such as AI across the enterprise, it was no surprise that over 53% of respondents are already leveraging these tools. The fact that 55% of respondents expect their budgets for workflow management tools to increase over the next year and 41% anticipate investing in new, additional solutions strongly suggests that many organizations are already reaping tangible benefits. When it comes to sub-type, 48% of respondents are opting for simple, straight-forward workflow automation. However, as organizations look to automate end-to-end business processes and achieve hyper automation in the wake of the COVID-19 pandemic, we expect investments in workflow management and orchestration tools to increase.

Are you currently leveraging workflow automation?

What types of workflow tools do you plan on investing in over the next year?

Do you expect your final, approved budget for workflow management tools to increase over the next year?

What percentage of your budget do you expect to invest in workflow automation?

Trends by Function

Document-heavy, data-driven and task oriented, finance processes such as accounts payable, invoicing and payroll are almost always strong candidates for automation, especially when one is just starting out.

Though organizations are clearly branching out into new areas when it comes to future deployments, at 51%, finance is significantly ahead of the pack when it comes to current applications.

In what areas is your organization currently leveraging workflow automation?

Do you expect your organization will expand workflow automation into any new areas next year?

As customer experience evolves as a battleground for competitive advantage, it makes sense that the top area for new workflow automation applications is customer service. It’s also interesting to note the drop in future deployments for HR, a function that, like finance, seems ripe for end-to-end business process automation.

However, in recent months, a number of unflattering pieces of investigative journalism have challenged automation heavy HR departments. From wrongfully initiating termination proceedings to perpetuating biased hiring decisions, the risks associated with over-engineering HR processes are substantial. Though we are certainly optimistic that, as these technologies mature, the risk of implementation will decrease, for now, it’s understandable why organizations might be pulling back automating HR workflows.

Vendor Showcase

What is clear from our vendor analysis is that many companies are leveraging more than one workflow automation and management tool. In addition, a substantial percentage seem to either be looking to change solutions or acquire additional ones.

This suggests that many organizations may be lacking a holistic workflow management strategy and, as a result, have yet to successfully scale workflow automation across the enterprise. However, going forward, companies will need to start breaking down silos and automating crossfunctional, human-in-the-loop processes in order to truly deliver transformational results.

WATCH: Transforming Data into Insight in Real-Time with AI

In addition, many of the leading solution providers, such as Automate.io, Kofax and Integrify, are branded as “low-code” solution providers. Down the line, will workflow automation & orchestration simply merge into low-code automation tools? Perhaps, but probably not for many more years.

Are you currently or considering leveraging any of the following workflow management solutions?

Intelligent Document Automation

The unsung hero of digital transformation, intelligent document automation (IDA) and processing (IDP) solutions leverage deep learning technologies such as RPA, AI and computer vision to extract unstructured data from documents (e.g., email text, PDF, and scanned documents) and convert it into structured data.

IDP solutions tend to be “non-invasive” and easily integratable into existing systems, business applications and platforms. However, when combined with workflow orchestration tools, IDP can be used to not only automate complex, document-based, human-in-the-loop processes, it also generates a wealth of decision-enhancing, along with machine consumable, data.

IDA Adoption & Trends

Though IDP has significant transformational potential, only 28% of our respondents are currently leveraging intelligent document automation of any kind. While 30% say they plan on adopting IDA within the next year, it’s clear that many companies have chosen to adopt other tools - such as workflow automation (54%), RPA (43%) and even intelligent automation (39%) – first.

Are you currently leveraging intelligent document automation (IDA)?

This may be because, until now, only especially document dependent industries (i.e., financial services, insurance, government) generated ROI with these tools. Afterall, though 56% of our respondents said that their IDA deployments had either met or exceeded business expectations, only 14% said that IDA increased process efficiency more than 50%.

By what percentage would you say IDA has increased process efficiency on average?

When it comes to delivering business value, would you say IDA met your initial expectations?

Budget & Vendor Overview

Though companies may have been on the slow side to adopt IDP, the tide is clearly turning. In addition to the anticipated 30% uptick in adoption over the next year, 36% of respondents also expect their budgets for IDA solutions to increase. We predict that the IDA market will continue to grow as organizations deepen their automation footprint and seek to cultivate more agile, distributed workforces.

In terms of existing and future partnerships, major enterprise automation players Automation Anywhere, UiPath and ServiceNow are leading the pack. However, Amazon Textract, Hyperscience and Appian are nipping at their heels.

Automation Anywhere’s IQ bot continues to stand out due the fact that it is easily integratable with Automation Anywhere’s suite of intelligent automation tools and because it offers pre-trained, out-of-the-box models for over 100 use cases. However, according to the Everest Group, it is somewhat limited when it comes to NLP.

In addition, the majority of its deployments fall into 4 key sectors:

- HR

- BFSI

- Finance

- Accounting and healthcare (payer)

Beyond these realms, the solution remains untested. These may be some of the reasons interest in alternative solutions is increasing.

Which IDA vendors are you currently working with?

Low-Code Automation

Low-code automation (LCA) solutions are business process automation (BPA) tools that require only minimal coding to function. As a result, they empower non-technical business professionals to automate routine and repeatable business processes with limited assistance from IT. In addition to equipping “citizen developers” with the ability to innovate on their own, it also reduces the administrative burden on IT, freeing them to focus on more high value activities.

Despite their promise, many organizations have been hesitant to adopt these tools. Though intended for non-technical users, they often still require significant training to operate effectively. In addition, if improperly managed, they can result in increased shadow IT and security risk.

Low-Code Adoption & Spend

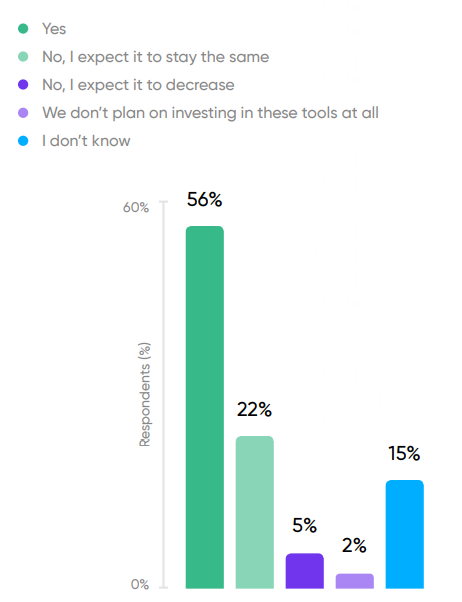

While 38% of respondents are currently leveraging low-code tools and 32% plan to eventually- a notable 30% have no plans to invest in low code at all. Though only 5% of those surveyed said their budgets are decreasing, it looks like, aside from those who are investing in LCA for the first time, budgets are somewhat stagnant.

Do you expect your final, approved budget for low-code solutions to increase over the next year?

- Yes- 32%

- We don’t plan on investing in these tools at all- 12%

- No, I expect it to stay the same- 30%

- I don’t know- 21%

- No, I expect it to decrease- 5%

What percentage of your budget is allocated to low-code automation solutions?

In the long run, as LCA technology continues to mature and the IT talent shortage compounds, we do expect low code adoption rates and budgets to increase. Furthermore, in addition to LCA-specific solutions such as those listed below- as mentioned earlier- many established workflow automation, RPA and intelligent automation players are incorporating low-code elements.

And they’re not alone. low code is spreading like wildfire across enterprise platforms of all kinds. For example, Salesforce offers its CRM users Einstein Automate, a feature that enables “anyone in a company to build intelligent workflows and integrate data across any system with clicks, not code.”

As more and more people use and experience the value of such tools first hand, LCA could soon become commonplace. Though LCA solutions will (probably) never be a suitable tool for building highly complex, enterprise workflows and systems, they will likely have a significant cultural impact. By further blurring the line between the business and IT, LCA may not only change the nature of work, but also unleash a golden age of innovation.

Vendor Break Down

Similar to process discovery, it looks like organizations are leveraging multiple tools across multiple functions. In addition, while 40% of respondents are currently using Microsoft Power Apps, in terms of future investment, attention is much more evenly spread.

Microsoft Power Apps is a strong tool with a stellar reputation and is a popular choice for those just starting out. However, in addition to other limitations, it can only be used to develop apps for internal use. With this in mind, it’s understandable why existing customers may be looking to branch out into other areas.

Are you leveraging any of the following Low Code Tools?

Automated Process Discovery

Automated business process discovery (ABPD) is a powerful tool for not only identifying which processes are best suited for automation, but also visualizing and re-engineering existing processes to increase performance, agility and transparency across the enterprise. By tracking human behaviour and, using AI, transforming that data into powerful process intelligence, automated discovery solutions are ushering a new era of advanced process analytics and design.

In other words, the goal of process discovery is to make the “invisible enterprise” visible through the creation of a digital twin.

Adoption & Spend

At 28%, current adoption rates are somewhat low. However, 40% of respondents plan to invest in process discovery solutions, pointing towards substantial future growth.

For organizations looking to harness the power of RPA and business process automation (BPA), process discovery is a powerful enabling technology. Afterall, the number one reason these tools fail is due to poor process selection. Furthermore, 80% of respondents said that their process discovery processes were still primarily if not entirely manual. In fact, only 7% have automated more than 50% of the process discovery practices.

With digital transformations on the rise, this will likely change. As companies look to automate more and more processes, the need to optimize process discovery processes, both in terms of efficiency and effectiveness, will intensify. This is confirmed by budget outlooks with 43% of our respondents saying they expect their process discovery automation budgets to increase over the next year.

Are you currently leveraging automated process discovery?

- Yes- 28%

- No, but looking to invest within the next year- 24%

- No, but plan to invest in the 2-5 years- 16%

- No, no plans to invest- 32%

Do you expect this percentage to increase or decrease over the next year?

What percentage of your process discovery efforts are automated?

Though we only inquired about automated process discovery tools, a related category of solutions, process mining tools, are also experiencing significant growth. In fact, according to recent reports, the global process mining software market size is expected to reach $3.5 billion by 2026, rising at a market growth of 39. 9% CAGR during the forecast period.

Though process mining and discovery tools complement each other, it’s important to note that they are not interchangeable. Process mining, which uses event commits and application logs to decipher a business process, sits at the foot of process automation by helping organizations define processes. However, these tools do not deliver the same level of detailed analysis as process discovery solutions and are less powerful enablers of advanced automation.

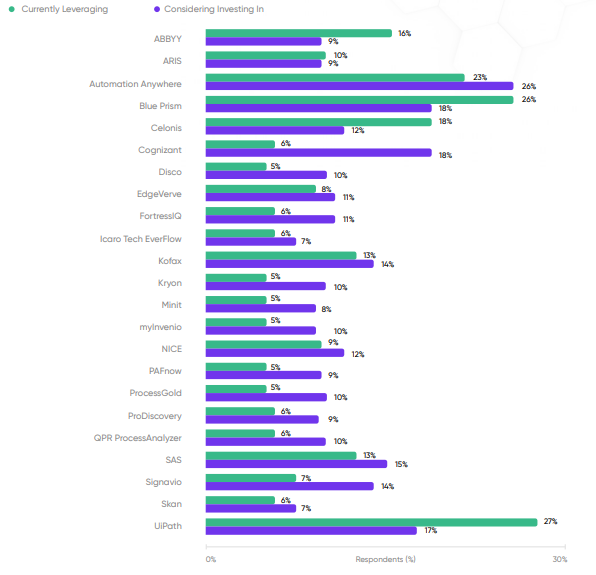

Process Discovery Vendor Analysis

When it comes to vendor selection, major industry players Blue Prism and UiPath are significantly ahead of the pack - both in terms of existing and potential future partnerships. Like many of their peers, both solution providers have automated process discovery features built into their core products. This begs the questions, are companies looking to invest in large enterprise automation systems that include process discovery technology? Or simply turning towards more recognized industry names for process discovery-specific solutions?

Are you currently leveraging or considering investing in any of the following process discovery tools?

Robotic Process Automation (RPA)

Robotic process automation (RPA) is a subset of business process automation technology whereby software “bots” are programmed to perform rule-based tasks much like a human would. For example, RPA software can log into IT systems and copy & paste data into an Excel sheet or report.

When properly scaled throughout the enterprise, RPA has the potential to dramatically improve efficiency and productivity. However, it is not without its downsides. For many organizations, RPA can be prohibitively expensive and difficult to implement. RPA “bots” also tend to be very fragile and do not adapt well to change.

This is where intelligent automation (IA) comes in. By adding artificial intelligence (AI) and machine (ML) to RPA, RPA becomes a bit nimbler and more scalable. As AI and ML can process unstructured and learn as they go, IA, essentially, links together “thinking” and “doing.”

In fact, by 2022, Gartner predicts that 80% of RPA-centric automation implementations will derive their value from complementary technologies.

The key for global corporate enterprise is to benefit from the collective intelligence presented by RPA and cognitive technologies along with human workers. Only by having technology combine with human talent can global corporate enterprise achieve scalable intelligent automation. And only with scalable intelligent automation enterprise resiliency be realized. Join that community for lessons learned at SRIA Live.Scalable RPA & Intelligent Automation Live

RPA Trends & Spend

RPA is having its moment in the sun. Though smaller companies have been much slower to adopt RPA, RPA is consistently one of the top areas of investment for large organizations. Furthemore, as the COVID-19 crisis has continued to fuel automation, the global RPA market is expected to reach $1.89 billion in 2021 (an increase of 19.5% from 2020) and large organizations are expected to triple the capacity of their existing RPA portfolios, according to Gartner.

All of this growth has not gone unnoticed by Wall Street. Over the past year, a number of RPA startups have received ample funding. For example, major player UiPath even landed a $35B valuation plus $750M in Series F funding this past February. Its competitor, Automation Anywhere, has received at least $840 million in disclosed funding and, in 2019, a valuation of 6.8 billion.

Are you currently leveraging RPA?

Do you plan on investing in RPA over the next year?

As for the data we collected, overall, 43% of those surveyed are currently leveraging RPA with 40% planning to invest in RPA over the next year. Of those who have already deployed RPA, well over half have only implemented 50 or fewer bots. This suggests that many of our respondents are still in the early, experimental phase of RPA implementation.

In fact, as we mentioned earlier in this report, only 12% of respondents have achieved fully scalable IA/RPA. This perfectly aligns with what we’ve on RPA specifically - that only about 12% of respondents have implemented RPA on more than 100 processes.

Historically speaking, many organizations have embraced a standard, factory-like approach to RPA implementation. First, they start small, piloting RPA on a single, rote process. Then, if things go well, they apply it to other processes one at a time.

However, this approach has a number of pitfalls. For starters, automating one, single repeatable process is rarely going to generate the value needed to justify the cost of RPA. Secondly, when every function or team is left to their own devices, organizations wind up with hundreds of overlapping but disparate solutions that may perform their given task well enough, but don’t work together, share information or serve any real unified purpose.

As a result, RPA has a rather high failure rate of around 50- 30% and, of those we surveyed, 60% said less than half of RPA deployments met business expectations.

Leading edge companies are realizing that in order for RPA to deliver transformational results, these tools must be part of a broader, enterprise-wide digital transformation strategy. To support this vision, 43% of respondents say that they expect their budgets (and organizational focus) on scaling RPA/IA to increase over the next year.

How many RPA bots are currently in production?

When it comes to delivering business value and ROI, what percentage of RPA deployments have either met or exceeded expectations over the past year?